By Claire Giangravé

The newly released Epstein files show that Jeffrey Epstein and Steve Bannon discussed opposition to Pope Francis, including a move that Bannon claimed would ‘take down Francis.’

Newly released files by the U.S. Department of Justice show that convicted sex offender and financier Jeffrey Epstein and former Trump aide Steve Bannon discussed strategies to undermine Pope Francis, revealing how the Vatican was viewed as a geopolitical pressure point by Epstein’s network of political and financial leaders.

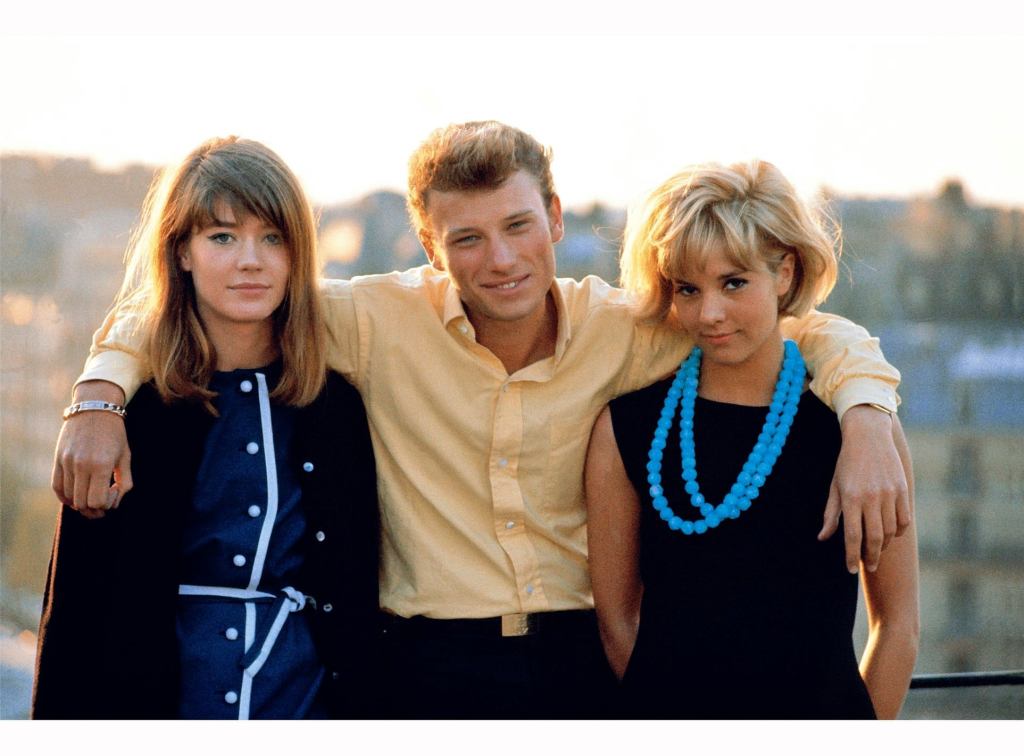

In text messages between Bannon and Epstein from June 2019, Bannon seems to suggest that Epstein was an executive producer of a documentary film that never got made, based on a 2019 book by French journalist and researcher Frédéric Martel, “In the Closet of the Vatican.”

“Will take down Francis,” Bannon writes about the film. “The Clintons, Xi, Francis, EU — come on brother.”

Martel’s book delves into the culture of secrecy and hypocrisy regarding homosexuality at the Vatican. When it was published, the book galvanized conservative outrage because it included claims stating that 80% of Vatican clergy are gay.

Martel told Religion News Service that he had several meetings with Bannon, who told Martel that he “loved” the book. The two met in Paris, in the penthouse suite of the Hôtel Bristol, where Bannon first floated the idea of adapting the book into a film. “He told me that he would like to do a movie about it,” Martel said, adding that “he was very enthusiastic.”

Martel clarified that he never accepted Bannon’s offer and never received any payment from him, as his French publisher controlled the rights to the book. Martel said he had no contact with Epstein.

Bannon’s interest in Martel’s book was enough to lead U.S. Cardinal Raymond Burke to cut ties with the Dignitatis Humanae Institute, a conservative Catholic organization that Burke felt had become too identified with Bannon. “I am not at all of the mind that the book should be made into a film,” Burke wrote in a letter dated June 25, 2019.

The correspondence between Epstein and Bannon took place at the height of concerted conservative efforts to oppose Francis, who had signaled his openness toward LGBTQ Catholics and divorced or remarried Catholics and who expressed concern for migrants and the environment in his public statements and written documents.

Overall, Francis had shifted the church’s tone from his immediate predecessors’ emphasis on enforcing doctrine, toward inclusion. The 2014-15 Synod on the Family, a meeting of Catholic bishops in Rome, broadened the church’s views on family life and ended with an apostolic exhortation that preached about “a church of mercy.” In its wake, conservative cardinals — including Burke — issued a challenge, known as a dubia, to Francis’ teaching.

The dissent reached its climax when the former papal representative to the United States, Archbishop Carlo Maria Viganò, published a scathing public letter accusing Francis of covering up the abuse by former Cardinal Theodore McCarrick.

“There’s a clear concerted campaign among a number of traditionalist figures and institutions to bring down Francis in the name of some sort of ‘purification,’ which culminates in the Viganò letter,” said Francis biographer Austen Ivereigh, who said the connections revealed in the Epstein files were an interesting new element. “What obviously is clear, though, is that they had formed an alliance of sorts.”

Emails between Bannon and Epstein dating to 2018 lament the Vatican’s push against xenophobia, racism and populism, as well as the Holy See’s relationship with China.

Epstein is often dismissive toward the papacy and Francis in the released correspondence. When Francis visited the U.S. in 2015, Epstein noted that the pope was staying near Epstein’s residence in New York. “I thought id invite him for a massage,” Epstein wrote in an email to his brother, Mark Epstein, followed by lewd remarks.

Jeffrey Epstein also seems to have had an interest in the Vatican’s finances. He was familiar with the book “Who Killed God’s Banker?: A 30 Year Investigation” by Edward Jay Epstein, detailing the financial structure of the Institute for Works of Religion, commonly referred to as the Vatican bank. In particular, the book comments on the 1982 collapse of Banco Ambrosiano, after which its president, Roberto Calvi, was found hanging from a noose under London’s Blackfriars Bridge.

In an email to Epstein in August 2014 about blockchain and digital currency, the Italian cybersecurity researcher Vincenzo Iozzo pointed to “the Vatican and Monaco” as small sovereign states that could be “viable” grounds for experimentation. “You said you like great hacks — selling companies and/or big western countries a currency that doesn’t actually exist is probably the ultimate hack in the world,” Iozzo wrote.

At the time, Francis had launched a major effort to reform the Vatican’s troubled and often opaque finances and appointed Cardinal George Pell to lead the newly formed Secretariat for the Economy. Francis also closed thousands of suspect accounts by non-Vatican City citizens.

An FBI report included in the DOJ’s release includes a source who claims that an Italian cybersecurity figure described as “Epstein’s Hacker” may have held a Vatican City passport.

Source: Epstein files reveal ties to Catholic conservatives’ anti-Francis campaign | National Catholic Reporter